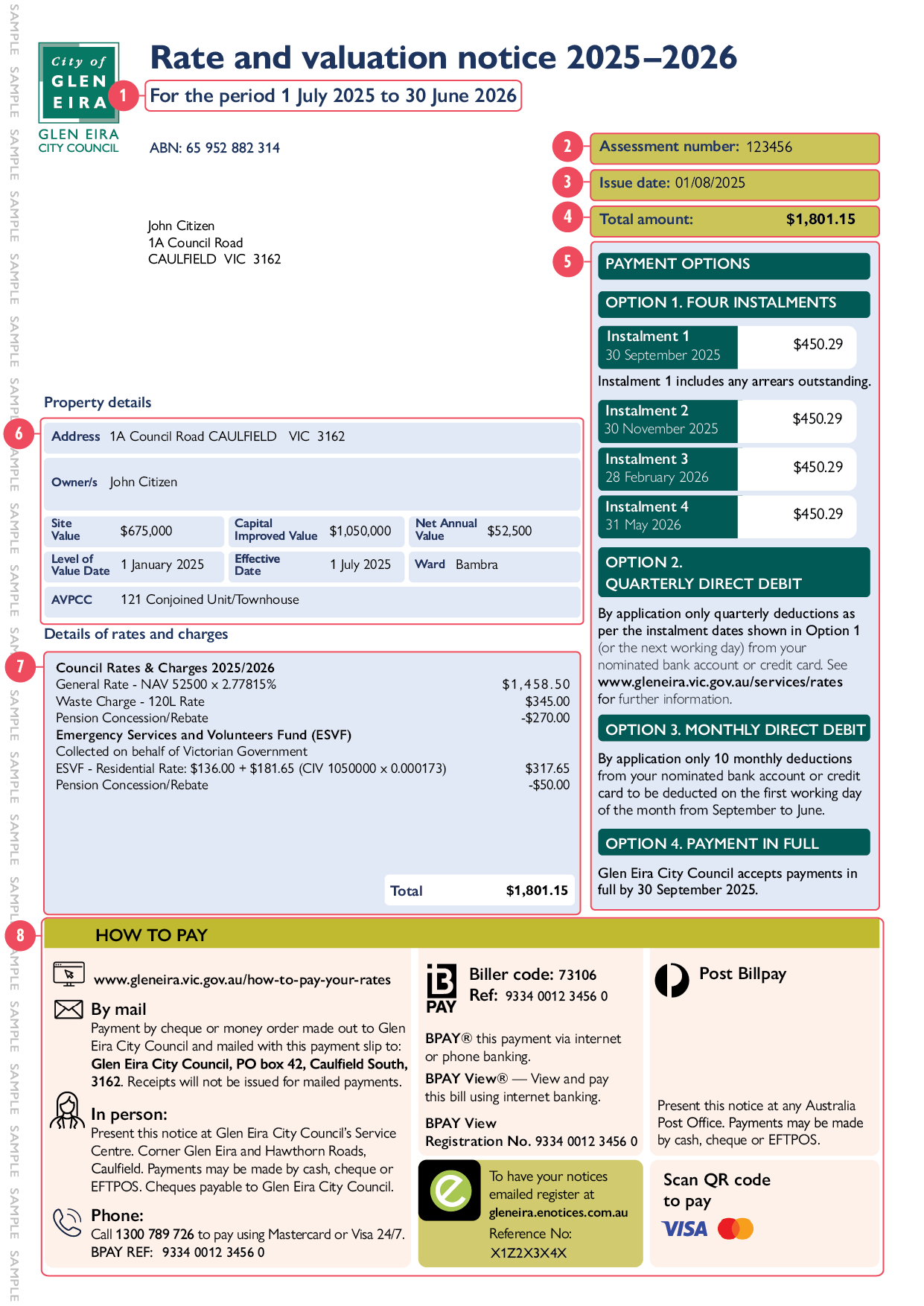

We've created a sample rate notice to help you understand yours.

How to read your rate and valuation notice

1. Rating year

This notice applies to the period from 1 July to 30 June each year.

2. Issue date

This date in which the notice has been issued and printed.

3. Assessment number

Glen Eira's identification of your property. Please have this handy when making enquiries regarding your rates notice.

4. Amount due

Total amount of rates due (including arrears, if applicable). From 1 July to 30 June each year.

5. Payment options

Payment Option 1

Your rates are due in four (quarterly) instalments by the dates outlined on your notice.

- Payment of the 1st instalment must be received by 30 September.

Payment Option 2

By request, quarterly payments will be deducted from your chosen bank account or credit card as an automated direct debit. Apply for direct debit

Payment Option 3

You can request 10 monthly payments to be deducted from your bank account or credit card on the first working day of each month from September to June. Apply for direct debit

Payment Option 4

Simply contact us to process your payment in full by 30 September.

NOTE: If you are on a direct debit your notice will look a bit different.

6. Property details

This section has your:

- Property address

- Owners names

- Site Value (SV) — Land value only

- Capital Improved Value (CIV) — Market value at date of valuation — land plus improvements

- Net Annual Value — Fixed at five per cent of the Capital Improved Value for residential properties. For non-residential properties assessed rental value.

- Level of Value Date — This is the date that the property was assessed and valued on.

- Effective Date — This is the date that the Valuation has been used to calculate the rates.

- Australian Valuation Property Classification Code (AVPCC) — This is assigned to your property according to the use of your land.

- Ward — This shows the area your property is located in, based on the Council’s ward boundaries.

7. Details of rates and charges

All relevant rates, charges, levies or rebates, including the Victorian Government's Emergency Services and Volunteers Fund (ESVF) Levy, are displayed as applicable to the property.

To find out more, read our How your rates are calculated page.

8. How to pay

-

Online: Scan the QR code on your Rates notice or visit gleneira.vic.gov.au/how-to-pay-your-rates

-

By mail: Send a cheque or money order with the slip to PO Box 42, Caulfield South 3162

-

In person: Pay at the Glen Eira City Council Service Centre (cash, cheque, EFTPOS)

-

Phone: Call 1300 789 726 (Visa or Mastercard)

-

BPAY: Use internet or phone banking with biller code 73106 and BPAY reference as displayed on your notice

-

Post Billpay: Pay at any Australia Post Office (cash, cheque, EFTPOS)